Loan Against Property

Purpose of the Loan:

- Lending facility on Real estate property (House/ flat) as equitable mortgage.

Eligibility:

- House/ Flat should be freehold.

- Tax returns for last 3 years.

- Have a saving account in the Loaning Bank branch.

- Incase of joint loan - Husband/ Wife/ Mother/ Father/ Son or Daughter in law.

Collateral Security:

- Property should be wholly owned, in case of co-ownership the mortgage equity should be of co-owners.

Term of Loan:

- The maximum duration of the loan will be 15 years or applicants age of 70 years, whichever is less.

Maximum Loan Amount:

- 60% of the market value of the property or Rs 30.00 Lakh or the debtor's ability to repay, whichever is less. The minimum loan amount will be Rs 2.00 Lakh.

Interest Rate:

- 12.00% compound annually which will be broadcasted on a monthly basis. On late installment a penal interest of 2% will be charged on the installment amount till the installment date.

Prerequisite for submission of title deeds:

- The property on which loans and mortgages will be provided for mortgage, will have to submit original title deeds of the property. In no case attested copies will be accepted.

The trial of mortgage property:

- By the authorized advocates of the Bank, the registered deed of the property will be tested and a mortgage certificate for 12 years will be provided.

- Evaluation of the property will be done by the Banks authorized evaluator.

Repayment and capacity assessment:

- 50% of monthly income, per month will be considered. Incase of non-salaried, the calculation will be made on the basis of income tax return.

- Incase of joint loan, the calculation will be done on the basis of both individuals salary.

- Installment will start from next month sanction of loan.

Processing Charge:

- Must submit the processing fee 0.5% of the loan amount requested by the applicant, it will not be returned in the event of loan approval.

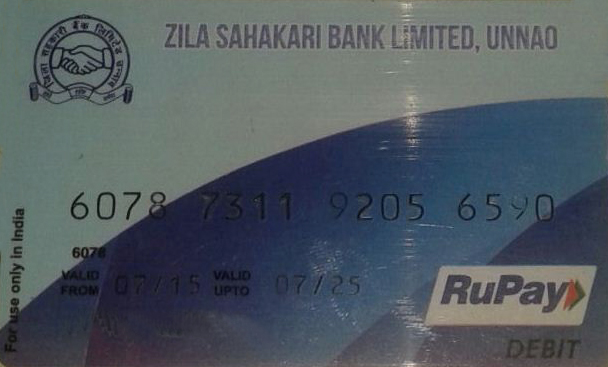

** For more information please visit your nearest branch of Zila Sahkari Bank Ltd. Unnao